City Pension Fund in Trouble… or Not?

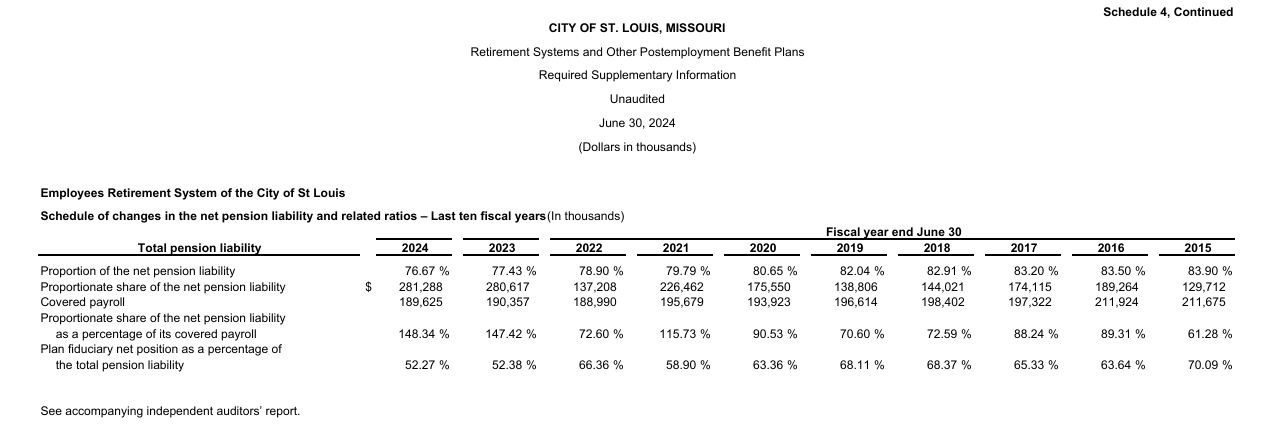

Following the recent release of St. Louis City’s 2024 Annual Comprehensive Financial Report (ACFR), concerns were raised about the health of the city’s Employee Retirement System (ERS). This is the pension system that covers non-first responder municipal employees, while the police and firefighters have separate pension funds. According to the ACFR, the fund’s fiduciary net position has significantly deteriorated over the past few years, standing at just 52%, well below the 65% threshold often considered the minimum for long-term pension stability. For context, the net position of the firefighter pension fund covering current employees stands at 75% and 71% for the police pension.

Sheila Weinbeg, Founder and CEO of the right-leaning nonprofit Truth In Accounting, responded to questions about the health of the city’s pension fund. “You’re right that 70% funding, while far from ideal, has been relatively common across public pension plans. But we shouldn’t confuse ‘common’ with ‘acceptable.’” Weinberg continued, “In fact, that level of underfunding would never be tolerated in the corporate world. Under federal law, private sector employers are required to maintain high funding levels for their pension plans. The rules are strict, for good reason: they’re designed to protect both employees and shareholders from the risks of pension shortfalls.”

Asked if this shortfall could have impacts on the city’s overall budgetary situation, Weinberg offered, “In a real sense, the city is already stepping in with capital. The rising pension contributions—especially when measured as a percentage of payroll—reflect increasing pressure on the city’s budget to support these underfunded plans. There’s no hard trigger point universally requiring immediate city intervention, but when funding levels drop below 60%, the risk of insolvency within a decade increases significantly if no corrective action is taken.”

When ERS staff was asked for comment, general counsel Scott Lee Harper stated that the ACFR was mistaken. He offered the system’s most recent actuarial report, which is available online, though the page for the report on the city’s website incorrectly states that it hasn’t been updated since 2017. In fact, almost every page in the ERS document section of the city’s website says that it has been years since they were updated. Most seem to have links to the most recent versions of pension documents, despite saying that they have not been updated.

In this latest report, the ERS shows a funding level of 74%. When asked about the large discrepancy, ERS consulted with Anders CPA, the pension’s auditor. The auditor noted that the pension’s 2023 actuarial report was the proper benchmark, as this was the one that concluded within the period covered by the ACFR. The 2023 report showed ERS funded at 68%. “The plan fiduciary net position as a percentage of the total pension liability reported on PDF page 186 of 52.27% (along with the other years), is incorrect. I figured out how this number was calculated which is not accurate. They took the same ratio for ERS (68.2% for 2023) and multiplied it by the City’s portion of the plan (76.67%). That is not the correct way to calculate the percentage. It should be based on the City’s portion of the fiduciary net position and total pension liability. When you do that, you get the same amount of 68.2%,” said a representative of Anders CPA. They also submitted a spreadsheet showing how the miscalculation would give the numbers referenced in the ACFR.

For their part, the Comptroller’s office says that this was all on purpose. “We certainly agree the System’s fiduciary net position as a percentage of total pension liability is 68.2%. However, we were conveying in our ACFR that, as a percentage of the total net pension liability of $1,153,001,981, St. Louis Citys’ government wide fiduciary net position is 52.28% or $602,774,067,” said Deputy Comptroller David Fletcher. Follow-up questions about why the city would choose to present the data in a way that both understated the pension’s health and confused accounting professionals were not answered.

KPMG LLP was the accounting firm that prepared the ACFR, and they were asked for comment on this story. They have not responded.